Understanding DMI

Learn more about the Data Matching Issues and how it affects your enrollments.

As an insurance agent, it's crucial to stay on top of customer data, particularly when it comes to Data Matching Issues (DMIs) in ACA health insurance enrollments. Failing to address these issues can result in reduced commissions, chargebacks, or even cancellations. DMIs occur when the information provided during enrollment doesn't match the records maintained by the Centers for Medicare & Medicaid Services (CMS). To ensure a smooth and trouble-free enrollment process, it's important to identify and resolve DMIs promptly. Here's a step-by-step guide to help you understand and tackle DMIs effectively:

What Are Data Matching Issues?

Data matching issues occur when the information provided on an applicant's ACA health insurance enrollment application does not align with the data available in government databases. These databases are primarily maintained by the Centers for Medicare & Medicaid Services (CMS) and can include data from sources like the Social Security Administration and the Department of Homeland Security. When there is a discrepancy between the information provided and the database records, data matching issues can occur.

Full List of Data Matching Issue Types

- Social Security Number

- Citizenship

- Immigration status

- Household Income

- American Indian or Alaska Native status

- No minimum essential job-based coverage

- No coverage through: Medicaid or the Children’s Health Insurance Program (CHIP)

- No coverage through: TRICARE

- No coverage through: Veterans Health Care Program

- No coverage through: Medicare

- No coverage through: Peace Corps

Common Causes of Data Matching Issues

Data matching issues can stem from various factors, including:

- Typographical Errors: Simple mistakes in names, addresses, or other personal information can lead to discrepancies.

- Incomplete Information: Missing data or incomplete fields on the application may cause a mismatch.

- Name Changes: Legal name changes that haven't been updated in government databases can result in discrepancies.

- Citizenship or Immigration Status Changes: Changes in an applicant's immigration or citizenship status can affect data matching.

- Multiple Entries: Having more than one entry in the government database can lead to confusion.

- Identity Theft: Cases of identity theft can lead to incorrect data in government databases.

How to Resolve Data Matching Issues

Resolving DMIs is essential to ensure that applicants receive the ACA health insurance coverage they qualify for. Here's a step-by-step guide for insurance agents:

- Review the DMI Notice: Carefully examine the DMI notice provided to you or your client. This notice will specify the type of DMI and the documentation required to resolve it.

- Gather Documentation: Collect the necessary documents to support the applicant's claims. This may include proof of income, citizenship, identity, or other eligibility criteria.

- Contact the Marketplace: Reach out to the Health Insurance Marketplace where the application was submitted. You can use the contact information on the DMI notice to initiate communication.

- Submit Documentation: Provide the required documentation as requested by the Marketplace. Be sure to submit complete and accurate information.

- Follow Up: Stay in touch with the Marketplace to monitor the progress of the DMI resolution. It may take some time to process the provided information.

- Assist the Applicant: Offer guidance and support to the applicant throughout the process, explaining the importance of timely document submission and clear communication.

Resolving DMIs through Health Sherpa

Provided by Health Sherpa

Agents can upload documents directly through HealthSherpa to resolve DMIs. Through your HealthSherpa account, you can see the DMI verification documents needed for all your clients, view a list of acceptable documents, upload documents, and see whether documents have been approved.

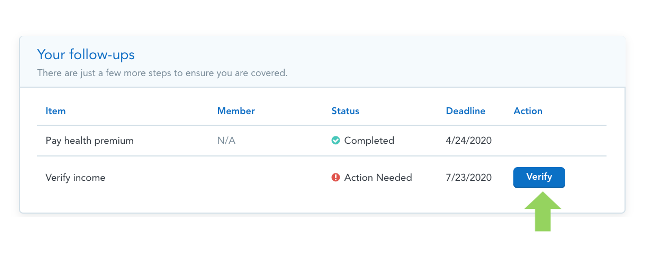

As an example, if you needed to verify income for a hypothetical client, you would see this in their Client Profile:

NEW Employer Coverage Verification

When your clients have or are offered job-based insurance, they typically won't qualify for Marketplace savings if the job-based plan is affordable and meets standards. However, they can explore Marketplace options to check eligibility without losing their job-based coverage. Help clients evaluate coverage benefits, costs, and provider networks to decide the best option. If they receive a job-based offer while on a Marketplace plan, updating their Marketplace application is crucial to understanding the impact on their savings eligibility. Use the Employer Coverage Tool to gather detailed information from clients' employers, ensuring accurate eligibility assessment for Marketplace savings.

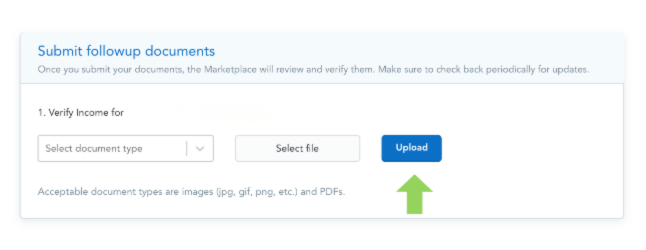

After clicking the ‘Verify’ button, you would be taken to a page where you can upload the appropriate documentation for the client.

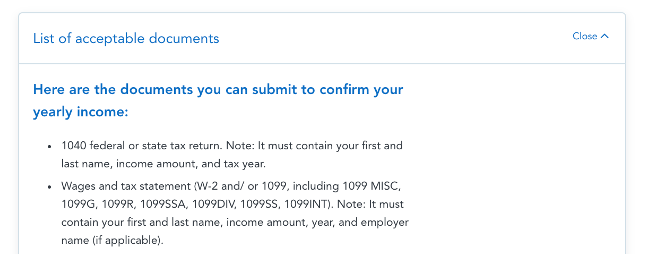

This page also includes information about what documents satisfy the ‘Verify income’ requirement.

Each DMI will have a different list of acceptable documents. Note that if you don’t have a document from the first list, you may need to refer to two subsequent lists. In some cases, one document from each of these two lists will be required. If the client does not have any of these accepted documents, refer to the forms “Annual Income Letter of Explanation” or “Letter to Confirm Application Information” available on the Agent Resources page.

Updated June 25, 2024